Risks of correction on real estate and mortgage market

The sharp rise in vacancy rates for investment properties, combined with the ongoing boom in construction activity, is exacerbating the risks in the Swiss real estate and mortgage market. Previous crises have shown that financial institutions which expand their activity in the late phase of an economic cycle are particularly exposed to the risks of an ensuing economic downturn.

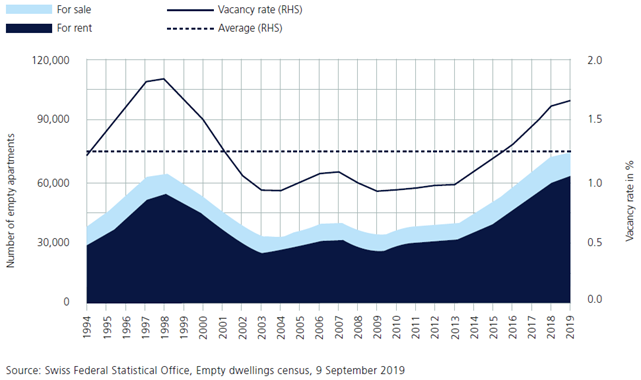

Negative interest rates increase the risk of bubbles forming in various asset classes, particularly in the real estate market. The sudden bursting of a bubble can have serious consequences for the financial markets, particularly if the underlying assets have been financed with debt. This is particularly true of the real estate market. Due to the persistently low interest-rate environment, investors have increasingly been seeking out higher-yielding investments. They are therefore increasingly investing in real estate, despite rising vacancy rates and falling rents. The result are ever-lower initial yields as real estate prices are driven up. This increases the risk of valuations falling sharply in the event of rising interest rates and loan-to-value guidelines for debt financing being breached. This would in turn have an adverse impact on lenders’ capital adequacy situation. On top of this, the combination of continued robust construction levels and declining net immigration is leading to oversupply in the residential property market. With some regional variations, rental vacancies are at a record high (see chart below), which puts rents and therefore investment returns under pressure. The imbalances are therefore growing along with the risk of a substantial future downturn in prices in the investment property sector. By contrast, vacancy rates in owner-occupied property have remained relatively stable in recent years. The problem of oversupply is less pronounced in this segment.

The consequences of a real estate crisis with a pronounced correction in prices could be significant:

- Rising credit default rates: stagnating demand for rental apartments leads to an oversupply situation. Vacancy rates rise and rents come under downward pressure, thereby reducing investors’ returns. A growing number of loan defaults would be likely in such a scenario, which would have to be absorbed by the banks’ capital.

- Fluctuations in insurers’ tied assets: alongside banks, insurers are also affected by falling real estate prices. As tied assets are measured at market value, any slump in prices would have a direct impact on the coverage of underwriting liabilities. The largest insurers could be hit by fluctuations in their tied assets running into the billions. Moreover, potential movements in asset values also have an impact on insurers’ capital requirements, as they are required to hold more capital under the solvency calculations of the Swiss Solvency Test (SST) if volatility is higher.

- Revaluation losses in real estate funds: declining real estate prices would also have a direct impact on the balance sheets and income statements of domestically invested real estate funds. Falling market values would feed through into revaluation losses. At the same time, leverage would rise.

Another focus of supervisory activity in recent years has been the real estate and mortgage market. Whereas initially attention was focused on the owner-occupied segment, it is now primarily the market for investment properties and the associated credit portfolios that are coming under intense scrutiny. This scrutiny will continue, and FINMA will intensify its oversight of financial institutions that exhibit particularly high growth in the mortgage business. In the banking sector, particular attention will be paid to developments in the buy-to-let market. This area of lending activity is not subject to the banks’ new stricter self-regulatory rules. In asset management, FINMA will undertake in-depth analysis of the risk management of real estate funds in particular. In the insurance area, FINMA will conduct a stress test with a view to gaining an insight into the impact of properties and mortgages held in investment portfolios on the solvency of insurance companies. Furthermore, FINMA will analyse the external valuation procedures used by insurance companies to value properties for potential modelling risks.

(From the Risk monitor 2019)