Focus on the large global Swiss banks

FINMA’s resolution strategy for a large global Swiss bank is to resolve these institutions at group level via a “single point of entry” bail-in (SPoE). This involves FINMA intervening at the level of the group holding company, i.e. UBS Group AG. For large international banks the SPoE approach has the key advantage that a resolution is carried out by the home supervisor alone. A bail-in is one of the main tools used in resolutions. It is designed to recapitalise the bank. The bank’s equity capital is first written down to zero and the AT1 bonds written off before certain creditors’ claims are converted into equity, which helps to rebuild the bank’s capital base. In the SPoE approach the bail-in bonds issued by the group holding company are converted into equity.

A large global bank is responsible for making all the preparations necessary to ensure resolvability. In particular, it is required to develop its own internal capabilities and eliminate obstacles to ensure that FINMA can restructure the entire group in a crisis. The measures and capabilities needed are defined by the “too big to fail” rules and the resolution strategies drawn up. There are interrelationships and interdependencies between these three elements of regulation, strategies and capabilities. As resolvability encompasses foreign entities, the expectations of foreign supervisory authorities are taken into account in relation to the resolution strategy. Achieving resolvability is a multi-year process for the bank, which is closely monitored by FINMA, the Swiss National Bank and the foreign supervisory authorities.

The Swiss emergency plan is designed to ensure continuity of systemically important functions if the bank is at risk of insolvency. FINMA has approved the Swiss emergency plans of Credit Suisse and UBS as effective and ready to implement. The applicable requirements must continue to be met and FINMA will review them annually. The merger of UBS and Credit Suisse will be taken into account in the recovery and resolution planning work by FINMA and the merged bank in the future.

Further improvements to resolvability

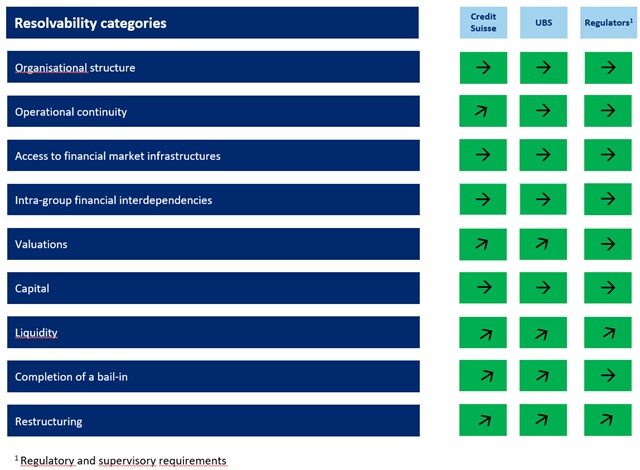

Both large banks made progress on their resolvability in a number of different areas in 2022. The resolvability assessment is broken down into nine categories in accordance with the revised Banking Ordinance. These are explained below and are summarised in the table.

FINMA believed both banks continued to meet the requirements for organisational structure, primarily owing to the establishment of holding structures and service companies in recent years and the transfer of systemically important functions to Swiss subsidiaries.

In the categories of “operational continuity” and “access to financial market infrastructures”, both large banks essentially fulfilled the resolvability requirements. Both institutions have concepts in place to regularly check compliance with these requirements.

The remaining work on the part of the banks in the areas of “valuations” and “restructuring” was largely completed. The banks have further developed and tested their ability to perform and report on the necessary calculations to implement a bail-in. In the area of “restructuring”, the regulatory requirements in this regard were specified in more detail.

In the area of “liquidity”, the estimation of potential liquidity needs in a given crisis scenario was tested again and the final implementations of the missing key figures were completed. The banks’ ability to provide the relevant data for the completion of a bail-in within 12 hours was also tested again. The legal and operational feasibility of a bail-in in the US capital market was reviewed and confirmed by an external assessment.

The new liquidity requirements of the amended Liquidity Ordinance, which came into force in July 2022 with a transitional period until 1 January 2024, still have to be implemented.

The status of the preparatory work at the end of 2022 is set out in the following table. The colour code shows the implementation status measured against the target of full global resolvability. The directional arrows show the progress that has been made since last year.

Status of preparatory work at the end of 2022

Colour code legend

- Green: preparatory work completed and regulatory and supervisory requirements defined

- Orange: preparatory work not completed or regulatory and supervisory requirements not defined in full yet

- Red: no plausible plan, preparatory work not started or regulatory and supervisory requirements not defined yet

Arrows legend

- Straight arrow: no significant change compared with last year

- Up arrow: material improvement compared with last year (with or without a change in colour code)

- Down arrow: material deterioration compared with last year (with or without a change in colour code)