Focus on the large global Swiss banks

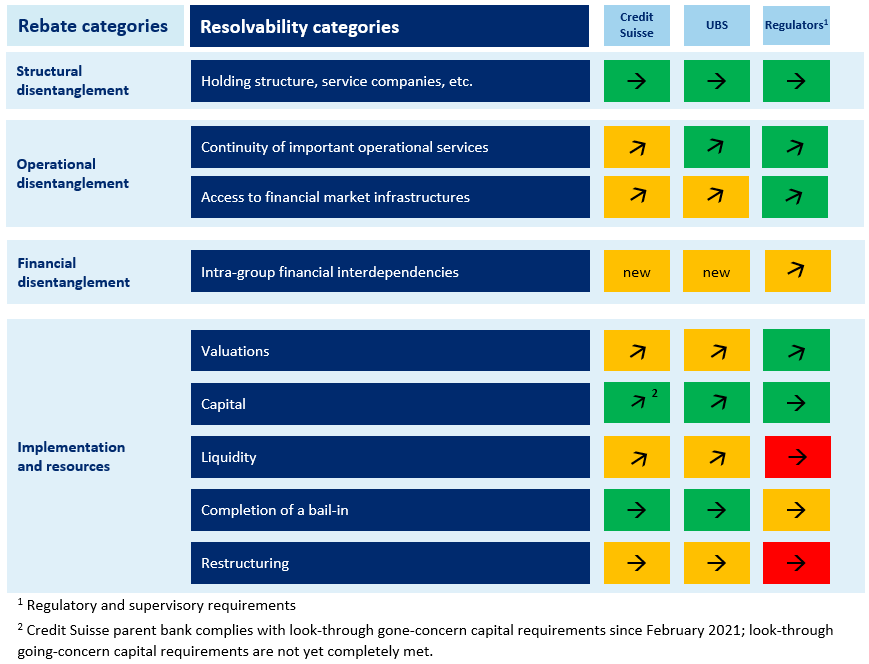

To achieve resolvability, the large global banks have to take all the necessary steps to develop their own capabilities and remove potential obstacles to FINMA restructuring or liquidating the entire group in a crisis. The measures and capabilities needed are defined by the TBTF rules and the resolution strategies drawn up for Credit Suisse and UBS. There are interrelationships and interdependencies between these three elements of regulation, strategies and capabilities (see the table below). As global resolvability encompasses the parts of the group located abroad, the expectations of foreign supervisory authorities are also taken into account in the resolution strategy. Achieving resolvability is a multi-year process that involves intensive and detailed work by all concerned. So far a number of important milestones have been reached.

Resolvability continues to improve

Both banks have made further improvements in their resolvability during 2020. Additional rebates on their gone concern capital requirements thus remain achievable for both institutions. The resolvability assessment is broken down into four predefined categories as set out in the table below.

FINMA believes both banks have met the requirements for structural disentanglement, primarily owing to the establishment of holding structures in recent years and the transfer of systemically important functions to Swiss subsidiaries.

There is further work to be done in the operational disentanglement category, in particular with regard to access to FMIs in a crisis situation. More work is also needed on implementation and resources. For example, crisis modelling and reporting capacities need to be further developed to ensure the banks are in a position to provide FINMA promptly with all the relevant information it needs in a crisis. The banks are also required to set out how their business models could be restructured following a crisis.

In terms of financial disentanglement within the group, UBS must carry out an in-depth analysis of the impact on resolvability of the adjustment of the parent bank's future business model. UBS complies with current FINMA-defined limits concerning intra-group financial interdependencies.

There is still work to do on a number of regulatory or supervisory requirements, particularly in the areas of financial disentanglement, liquidity and post-bail-in restructuring.

The status of the preparatory work at the end of 2020 is shown in the table below. The colour code shows the implementation status measured against the target of full global resolvability. The directional arrows show the progress that has been made since last year.

Status of preparatory work at the end of 2020

Colour code legend

- Green: Preparatory work completed and regulatory and supervisory requirements defined

- Orange: Preparatory work not completed yet or regulatory and supervisory requirements not yet defined in full

- Red: No plausible plan, preparatory work not started yet or regulatory and supervisory requirements not yet defined

Arrows legend

- Sideways arrow: no significant change compared with last year

- Upwards arrow: material improvement compared with last year (with or without a change in colour code)

- Down arrow: material deterioration compared with last year (with or without a change in colour)