Climate change risks

The financial risks associated with climate change may be material for Swiss financial institutions. The source of climate risks for banks, asset managers or insurers is usually physical consequences of climate change or climate-related transition risks, for example due to climate policy measures. For instance, assets in impacted sectors of the economy could become illiquid on the balance sheets of financial institutions or be exposed to increased valuation risks. As a general rule, climate-related financial risks can be classified and captured in the classic risk categories such as credit, market, insurance or operational risk, so there is not therefore any new risk category, but rather a new risk driver. However, there are specific challenges because of the special characteristics of climate risks.

At present, climate-related financial risks are not defined either in law or in any other generally applicable form. In its supervisory practice, FINMA follows the definitions and recommendations of international standard-setting bodies such as the Basel Committee on Banking Supervision (BCBS), the International Organization of Securities Commissions (IOSCO), the International Association of Insurance Supervisors (IAIS) and relevant guidance and recommendations by the Central Banks and Supervisors Network for Greening the Financial System (NGFS).

Transition risks

In the case of transition risks, the focus is on the transition to a society that emits less greenhouse gas. Climate policy measures or technological breakthroughs relevant to climate change mitigation can generate significant indirect risks of various kinds for financial institutions. For example, a financial institution may be invested in a company (market risk) or extend loans to a company (credit risk) that is unable to keep pace with political measures or technological developments. Other possible risks are legal risks due to corporate wrongdoing or changes in case law as well as abrupt changes in the behaviour of market participants and the resulting reputational risks for involved financial institutions.Physical risks

In the case of physical risks, a general distinction is made between acute and chronic risks. Acute risks focus on event-driven incidents, such as storms or floods. Chronic risks mean longer-term impacts, such as rising sea levels. These risk drivers could trigger losses (including unexpected losses) for financial institutions through the classic risk categories (credit risk, market risk, etc.).

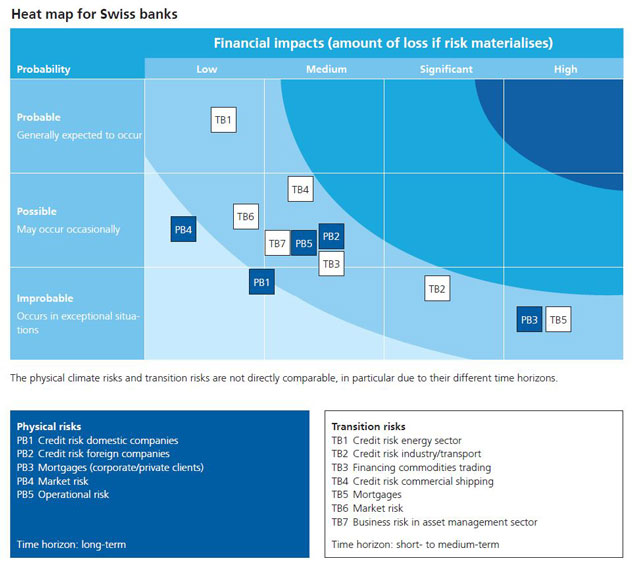

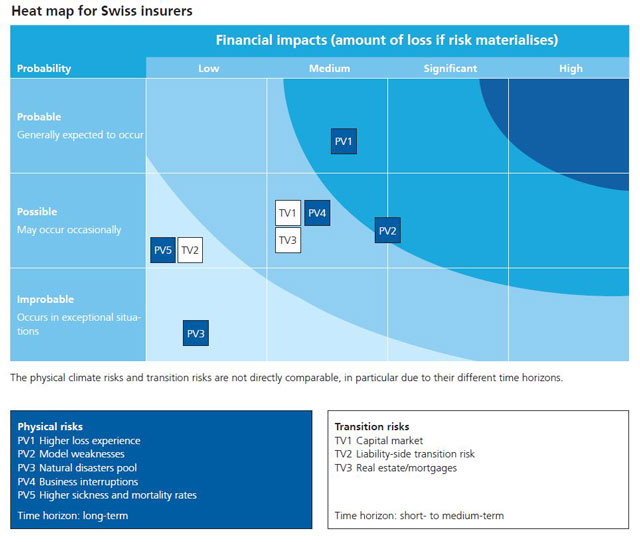

Heat maps

FINMA prepared a qualitative assessment of climate-related financial risks for the Swiss financial market between 2020 and 2021 and correlated them based on their probability of occurrence and the financial impact if they were to materialise. This resulted in the heat maps for the banking and insurance sectors shown in the following. FINMA used these as a basis for discussing the issue of climate-related financial risks with the supervised institutions. It is constantly refining its risk assessment as part of the integration of climate risks into supervision.

Climate-related financial risks at Swiss banks

Further information and explanations of the individual financial risks for banks and their positioning in the heat map can be found in the 2020 Annual Report (page 39).

Climate-related financial risks at Swiss insurers

Further information and explanations of the individual financial risks for insurers and their positioning in the heat map can be found in the 2020 Annual Report (page 41).